[{"id":"295","navid":"2","index":"0","name":"\u9996\u9875","icon":"","parentid":"0","type":"list","alias":"sy-x","url":"http:\/\/m-yuanan.cjyun.org\/sy-x\/index.html","appid":null,"children":[]},{"id":"296","navid":"2","index":"0","name":"\u8981\u95fb","icon":"","parentid":"0","type":"list","alias":"yw-x","url":"http:\/\/m-yuanan.cjyun.org\/yw-x\/index.html","appid":null,"children":[]},{"id":"297","navid":"2","index":"0","name":"\u89c6\u9891","icon":"","parentid":"0","type":"list","alias":"sp-x","url":"http:\/\/m-yuanan.cjyun.org\/sp-x\/index.html","appid":null,"children":[{"id":"302","navid":"2","index":"0","name":"\u3010\u8fdc\u5b89\u65b0\u95fb\u3011","icon":"","parentid":"297","type":"list","alias":"yaxw302","url":"http:\/\/m-yuanan.cjyun.org\/yaxw302\/index.html","appid":null,"children":[]},{"id":"304","navid":"2","index":"0","name":"\u3010\u65b0\u95fb\u7efc\u8ff0\u3011","icon":"","parentid":"297","type":"list","alias":"xwzs","url":"http:\/\/m-yuanan.cjyun.org\/xwzs\/index.html","appid":null,"children":[]},{"id":"305","navid":"2","index":"0","name":"\u77ed\u89c6\u9891","icon":"","parentid":"297","type":"list","alias":"dsp","url":"http:\/\/m-yuanan.cjyun.org\/dsp\/index.html","appid":null,"children":[]},{"id":"306","navid":"2","index":"0","name":"\u6d3b\u52a8\u8d5b\u4e8b","icon":"","parentid":"297","type":"list","alias":"hdss","url":"http:\/\/m-yuanan.cjyun.org\/hdss\/index.html","appid":null,"children":[]}]},{"id":"298","navid":"2","index":"0","name":"\u4e61\u9547","icon":"","parentid":"0","type":"list","alias":"xiangzhen","url":"http:\/\/m-yuanan.cjyun.org\/xiangzhen\/index.html","appid":null,"children":[{"id":"78","navid":"2","index":"0","name":"\u9e23\u51e4\u9547","icon":"","parentid":"298","type":"list","alias":"mfz","url":"http:\/\/m-yuanan.cjyun.org\/mfz\/index.html","appid":null,"children":[]},{"id":"150","navid":"2","index":"0","name":"\u8305\u576a\u573a\u9547","icon":"","parentid":"298","type":"list","alias":"mpcz","url":"http:\/\/m-yuanan.cjyun.org\/mpcz\/index.html","appid":null,"children":[]},{"id":"132","navid":"2","index":"0","name":"\u5ad8\u7956\u9547","icon":"","parentid":"298","type":"list","alias":"lzz","url":"http:\/\/m-yuanan.cjyun.org\/lzz\/index.html","appid":null,"children":[]},{"id":"138","navid":"2","index":"0","name":"\u6cb3\u53e3\u4e61","icon":"","parentid":"298","type":"list","alias":"hkx","url":"http:\/\/m-yuanan.cjyun.org\/hkx\/index.html","appid":null,"children":[]},{"id":"84","navid":"2","index":"0","name":"\u65e7\u53bf\u9547","icon":"","parentid":"298","type":"list","alias":"jxz","url":"http:\/\/m-yuanan.cjyun.org\/jxz\/index.html","appid":null,"children":[]},{"id":"144","navid":"2","index":"0","name":"\u6d0b\u576a\u9547","icon":"","parentid":"298","type":"list","alias":"ypz","url":"http:\/\/m-yuanan.cjyun.org\/ypz\/index.html","appid":null,"children":[]},{"id":"126","navid":"2","index":"0","name":"\u82b1\u6797\u5bfa\u9547","icon":"","parentid":"298","type":"list","alias":"hlsz","url":"http:\/\/m-yuanan.cjyun.org\/hlsz\/index.html","appid":null,"children":[]}]},{"id":"299","navid":"2","index":"0","name":"\u76f4\u64ad","icon":"","parentid":"0","type":"list","alias":"zb-x","url":"http:\/\/m-yuanan.cjyun.org\/zb-x\/index.html","appid":null,"children":[{"id":"219","navid":"2","index":"0","name":"\u7535\u89c6\u5e7f\u64ad","icon":"","parentid":"299","type":"template","alias":"dsgb","url":"http:\/\/m-yuanan.cjyun.org\/dsgb\/index.html","appid":null,"children":[]},{"id":"251","navid":"2","index":"0","name":"\u76f4\u64ad\u8fdc\u5b89","icon":"","parentid":"299","type":"list","alias":"zbya","url":"http:\/\/m-yuanan.cjyun.org\/zbya\/index.html","appid":null,"children":[]},{"id":"252","navid":"2","index":"0","name":"\u7701\u5185\u76f4\u64ad","icon":"","parentid":"299","type":"list","alias":"snzb","url":"http:\/\/m-yuanan.cjyun.org\/snzb\/index.html","appid":null,"children":[]}]},{"id":"300","navid":"2","index":"0","name":"\u90e8\u95e8","icon":"","parentid":"0","type":"list","alias":"bumen","url":"http:\/\/m-yuanan.cjyun.org\/bumen\/index.html","appid":null,"children":[]},{"id":"301","navid":"2","index":"0","name":"\u901a\u77e5\u516c\u544a","icon":"","parentid":"0","type":"list","alias":"tzgg301","url":"http:\/\/m-yuanan.cjyun.org\/tzgg301\/index.html","appid":null,"children":[]}]

登录长江云平台账号

登录长江云平台账号

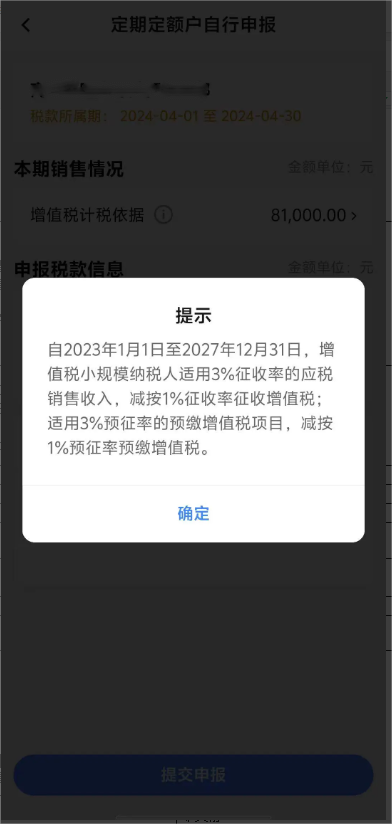

【小远说税】—定期定额户自行申报(APP版)

2024-12-09 11:06

![Screenshot_20231121_112314_cn.gov.chinatax.gt4.app[2]](https://img.cjyun.org.cn/a/10106/202412/16bcb8aa091e4ff610999dd09b553cc3.png)

![Screenshot_20231121_113324_cn.gov.chinatax.gt4.app[1]](https://img.cjyun.org.cn/a/10106/202412/f3a32a3769d8e3ddef232556099d920e.png)

![Screenshot_20231121_112556_cn.gov.chinatax.gt4.app[1]](https://img.cjyun.org.cn/a/10106/202412/7e4ece6a6eb9ad9906dfac65a013ef00.png)

![Screenshot_20231121_114948_cn.gov.chinatax.gt4.app[1]](https://img.cjyun.org.cn/a/10106/202412/47ef3ae3836a5c0e1983b9535586fce1.png)

![Screenshot_20231121_112400_cn.gov.chinatax.gt4.app[1]](https://img.cjyun.org.cn/a/10106/202412/c356e3192d6d0f96c07ace0df1173a34.png)