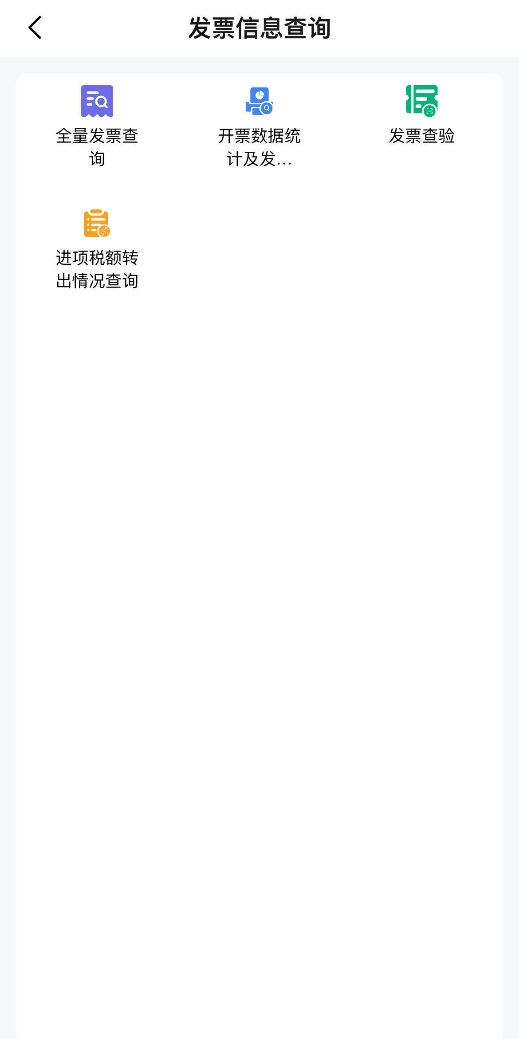

发票信息查询

全量发票查询

业务概述

纳税人可通过发票查询模块查询本人各个渠道开出和收到的发票数据、海关缴款书数据并可详细展示票据数据、票据状态等数据,还可以为纳税人提供自行交付的方式实现电子发票交付。

功能路径

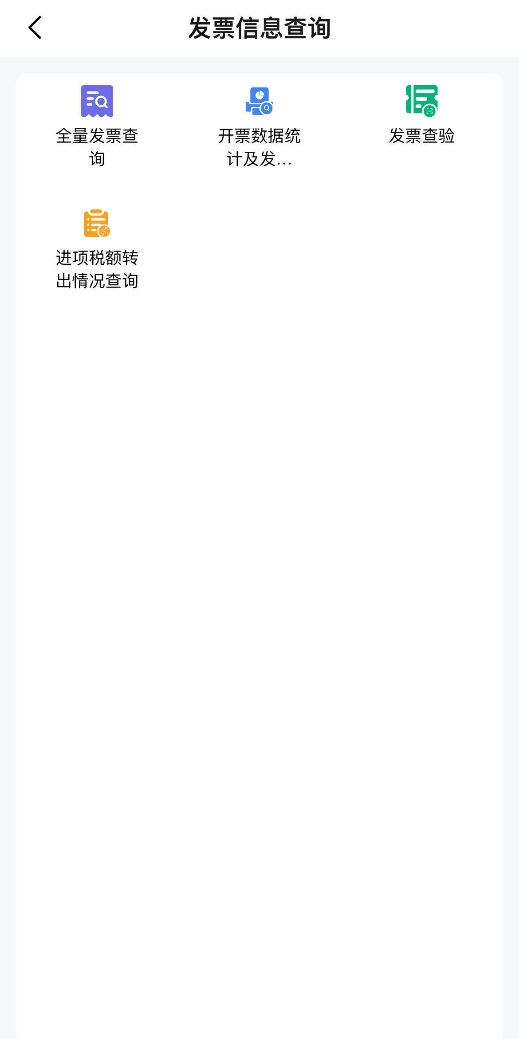

通过依次选择【办税】-【发票使用】-【发票信息查询】-【全量发票查询】功能菜单进入发票查询页面。

可以通过首页自定义去【全量发票查询】模块或者通过搜索栏输入关键字查找。

操作步骤

前置条件:纳税人存在取得或开具的发票、海关缴款书。

操作流程:登陆后,功能菜单依次选择【办税】-【发票使用】-【发票信息查询】-【全量发票查询】功能菜单进入发票查询页面;也可以通过首页自定义去【全量发票查询】模块或者通过搜索栏输入关键字查找。

进入“全量发票查询”页面,在“发票查询”TAB页提供“全量”和“近24小时”两种查询模式,纳税人可根据实际情况进行选择,正确录入查询条件,点击【查询】(此处以查询类型为“开具发票”为例)。

点击对应发票,进入“发票详情”页,可查看该张发票的基本信息、销售方信息和购买方信息。

点击【交付】(查询类型为“取得发票”时,此处显示为【下载】),进入“发票交付”页面,系统提供邮箱交付、二维码交付、下载PDF、下载OFD、下载XML五种交付方式,纳税人可根据实际需要选择发票交付方式。

进入“海关缴款书”TAB页,正确录入查询条件,点击【查询】。

单击对应海关缴款书,可进入海关缴款书详情页,单击货物信息可查看该条货物的详细下钻信息。

注意事项

系统提供二维码下载、下载PDF、下载OFD、下载XML四种下载方式,仅数电票(电子发票)支持下载功能,数电纸质发票和海关缴款书不提供下载功能。

查询农产品收购发票、光伏收购发票时,查询类型选择“开具发票”和“取得发票”均能查到同一张发票。

海关缴款书不支持预览功能。

开票数据统计及发票领用查询

业务概述

本功能在纳税人在电子发票服务平台移动端打开“开票数据统计及发票领用查询”界面后,可查询发票汇总数据。汇总数据包括按发票种类统计(领票)、按发票种类统计(开票)、按税率/征收率统计数据。

功能路径

通过依次选择【办税】-【发票使用】-【发票信息查询】-【开票数据统计及发票领用查询】功能菜单进入“开票数据统计及发票领用查询”界面。

通过首页自定义去【开票数据统计及发票领用查询】模块或者通过搜索栏输入关键字查找。

操作步骤

前置条件:存在发票领票及开票数据。

操作流程:登陆后,功能菜单依次选择【办税】-【发票使用】-【发票信息查询】-【开票数据统计及发票领用查询】功能菜单进入“开票数据统计及发票领用查询”界面;也可以通过首页自定义去【开票数据统计及发票领用查询】模块或者通过搜索栏输入关键字查找。

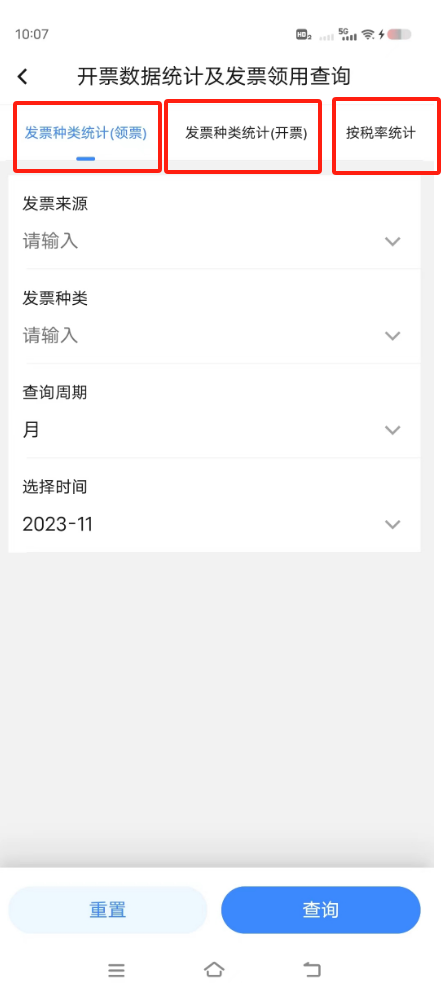

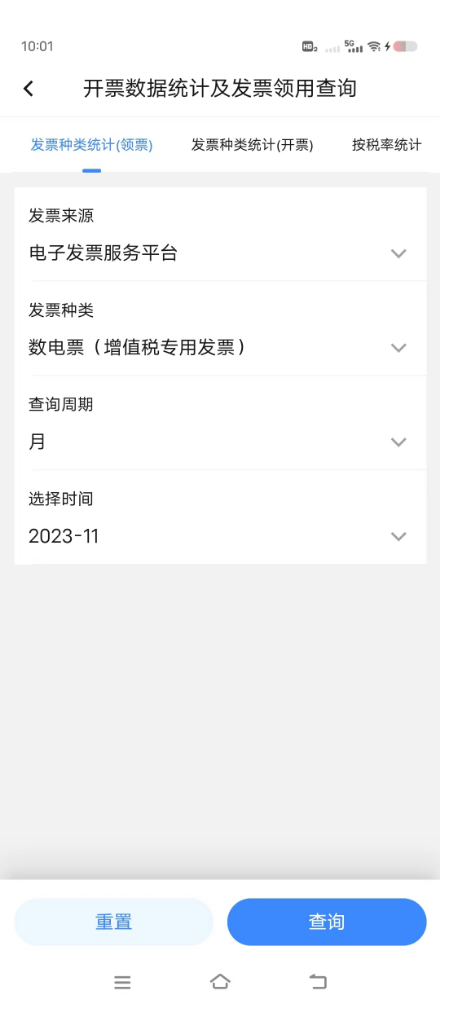

打开“开票数据统计及发票领用查询”界面后,查询“发票种类(领票)”、“发票种类统计(开票)”、“按税率/征收率”统计数据可点击界面上方的名称切换查询界面。

切换至要查询的界面后,选择【发票来源】,【发票种类】,并设置【查询周期】、【选择时间】查询条件,点击【查询】按钮。

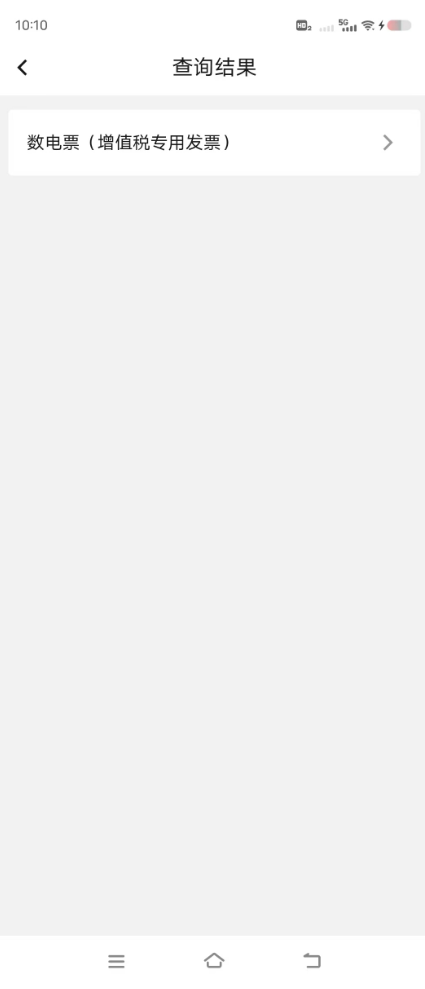

在“查询结果”界面点击要查询的发票种类。

发票种类(领票)的“票种详情”界面查询结果显示如下。

“发票种类统计(开票)”的“票种详情”界面查询结果显示如下。

按税率/征收率的“票种详情”界面查询结果显示如下。

注意事项

发票种类与发票来源进行联动,当发票来源选择电子发票服务平台时,展示电子发票服务平台所包含发票种类(数电票(增值税专用发票)、数电票(普通发票)、数电纸质发票(增值税专用发票)、数电纸质发票(普通发票)、数电票(航空运输电子客票行程单)、数电票(铁路电子客票));当发票来源选择增值税发票管理系统时,展示增值税发票管理系统所包含发票种类(增值税电子专用发票、增值税电子普通发票、增值税专用发票、增值税普通发票、机动车销售统一发票、二手车销售统一发票、增值税普通发票(卷式)、道路通行费电子普通发票)。

发票查验

业务概述

税务机关通过电子发票服务平台(包括网页端、客户端、移动端和数据接口服务渠道)为纳税人提供7*24小时在线的发票查验服务。

功能路径

通过依次选择【办税】-【发票使用】-【发票信息查询】-【发票查验】功能菜单进入发票查验页面。

通过首页自定义去【发票查验】模块或者通过搜索栏输入关键字查找。

操作步骤

前置条件:存在发票。

操作流程:登陆后,功能菜单依次选择【办税】-【发票使用】-【发票信息查询】-【发票查验】功能菜单进入发票查验页面;也可以通过首页自定义去【发票查验】模块或者通过搜索栏输入关键字查找。

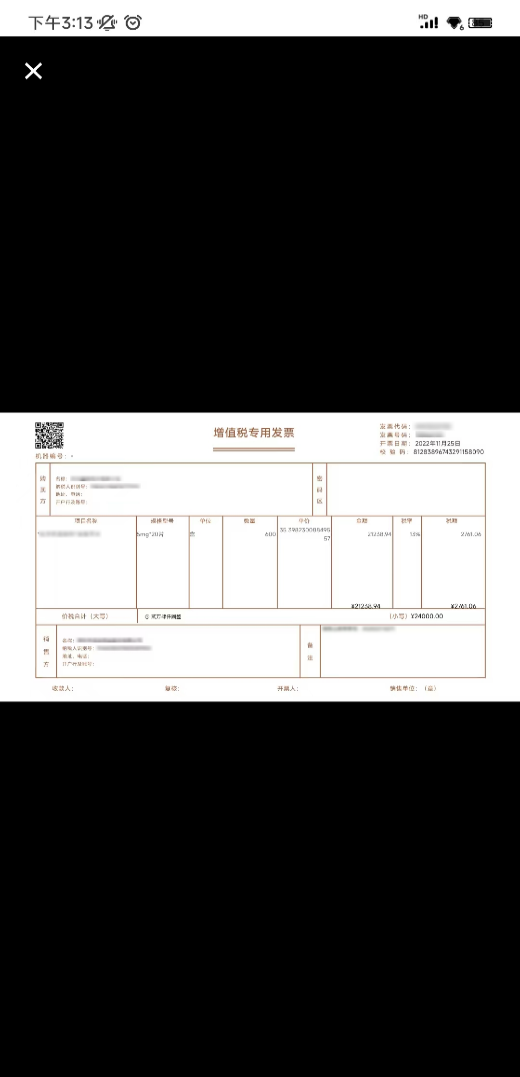

进入“发票查验”页面,可通过扫描已开具发票的票面二维码带出相关信息,也可在页面手动录入发票相关信息后点击【确定】按钮;若为本人发票,则只录入发票号码就可以查验,若为第三方发票,则提示填入开票日期及开票金额(含税金额)后进行查验。

查验本人发票,且结果一致时,反馈查验结果“经查验,发票信息一致”,同时展示发票票面信息、发票标签信息(包括发票用途标签及红字发票标签等)及发票查验时间等信息;点击【预览发票】可以预览发票的票面。查询结果不一致的,反馈结果“经查验,发票信息不一致”,查验结果为不一致时不可预览发票。若未查到该发票信息,反馈结果为“未查询到该发票信息”。

查验第三方发票时,查验结果一致的反馈提示“第三方发票,经查验,发票信息一致”,查验结果一致时可点击【预览发票】查看发票票面信息;结果不一致的反馈提示“第三方发票,经查验,发票信息不一致”,查验结果不一致时不可预览发票;若未查到,系统反馈“第三方发票,未查询到该发票信息”。

注意事项

查验风险开票人开具的风险发票时,系统给出相应提示。

进项税额转出情况查询

业务概述

查询对应属期应做进项税额转出的发票,以及应做进项税额转出的红字发票信息确认单信息查询统计。

功能路径

通过依次选择【办税】-【发票使用】-【发票信息查询】-【进项税额转出情况查询】功能菜单进入页面。

通过首页自定义去【进项税额转出情况查询】模块或通过搜索栏输入关键字查找。

操作步骤

前置条件:纳税人发生进项税额转出业务。

操作流程:登陆后,功能菜单依次选择【办税】-【发票使用】-【发票信息查询】-【进项税额转出情况查询】功能菜单进入页面;也可以通过首页自定义去【进项税额转出情况查询】模块或通过搜索栏输入关键字查找。

进入“进项税额转出情况查询”页面,点击【选择属期】按钮,选择需要查询月份,系统自动带出数据;点击【查看明细】进入“查看结果”页详细查看数据信息。

“查询结果”页通过页面【筛选】录入信息后点击【查询】进行筛选数据。

选择具体发票数据,可进入“发票详情”页查看发票详情,点击【发票预览】查询发票票面信息。

注意事项

无。